Services

Wealth Management

Safely, Securely, Sustainably

1-on-1 Wealth Consultations

Investor Assessment

- Your ability and willingness to take risk

- Your required rate of return

- Your time horizon

- Tax and legal considerations

- Other unique circumstances

our World of Asset Classes, All in One Place

Offshore Instruments

Tailor-Made, Because No Two Clients Are the Same

Structured Notes

Competitive Advisory Fees

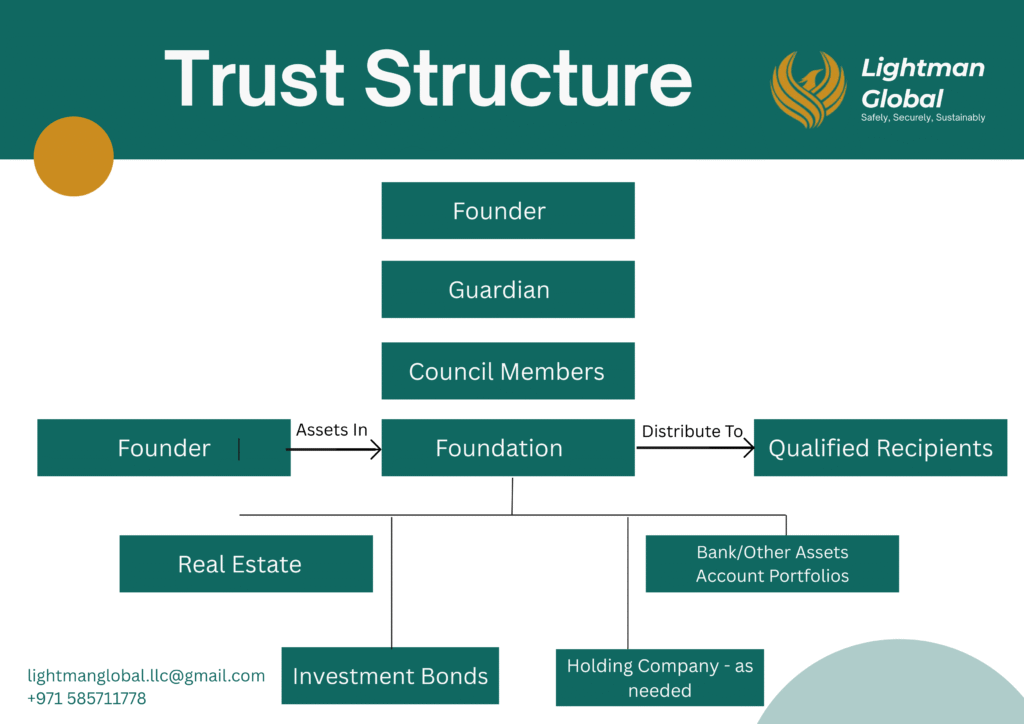

Estate Planning

Let’s structure your legacy—together.

What We Offer

Full Process Management

From advisory to facilitating bank account setup

Practical, Maintainable Structures

Built to fit your lifestyle and asset mix

Succession-Ready

Designed to ensure clarity, not courtroom battles

Compliance First

Legally sound, globally recognized structures

Why Choose Us

Mortgages

What We Offer

Resale Financing

Financing for completed properties in the secondary market — with competitive terms and full support.

Buyout

Switch your current mortgage to a better rate and reduce monthly EMI by moving to a new bank — without hassle.

Equity Release

Unlock liquidity from your existing property to fund investments, personal goals, or consolidate debt — without selling your asset.

Handover Payment Finance

Finance the final installment due at property handover — easing short-term cash pressure while securing long-term assets.

Our Process

Simple, Fast, Reliable

- Initial Consultation – We understand your objectives and assess your eligibility. ategy & Training – Empowering teams through capability-building and performance alignment.

- Bank Comparisons – We evaluate top lenders and present customized offers based on your needs.

- Pre-Approval & Documentation – Get conditionally approved while we manage the paperwork — no guesswork, no missed steps.

- Valuation & Final Approval – We coordinate directly with banks and valuers to keep things moving.

- Final Offer & Registration – We ensure smooth execution, registration, and handover — with zero last-minute surprises.

Who We Serve

- UAE Residents & Expats

- Overseas Buyers Investing in the UAE

- First-Time Homebuyers

- Portfolio Investors & Entrepreneurs

- Bulk Acquirers

Asset-Backed Lending

What Is Asset-Backed Lending?

How Asset-Backed Lending Works

- Preserve long-term strategy

- Avoid short-term tax implications

- Stay invested for potential upside

Our Core Focus

- Discreet – No personal guarantees

- Strategic – Built around your goals, not just your portfolio

- Responsive – Because financial needs don’t wait

Key Advantages of Collateral-Backed Loans

Diversified Collateral Options

Accepting public equities, ETFs, bonds, mutual funds, and major cryptocurrencies — for broad access to capital across asset classes.

Liquidity Without Liquidation

Access funding while keeping your investments intact and positioned for future growth.

Preserve Asset Value

Avoid selling at a loss, paying unexpected taxes, or missing upside potential.

True Non-Recourse Lending

The loan is secured only by the pledged asset — no additional liability, no personal guarantees.

Competitive Rates

Clear, efficient pricing that protects both cash flow and long-term plans.

Confidential & Efficient

Designed for speed, privacy, and smooth execution — ideal for short windows of opportunity.

Tailored Terms

Every client’s situation is unique — so every loan is structured around your portfolio, your timeline, and your level of comfort.

Personal Lending

- Competitive interest rates and clear repayment terms

- Loans for salaried, self-employed, and non-residents

- Support with documentation and eligibility requirements

- End-to-end guidance from inquiry to disbursal

- Other unique circumstances