Thought leadership

Why Most People's Savings Won't Survive Retirement And (How to Fix It)

We used to plan for a retirement of fifteen to twenty years. Today, a healthy person stopping work at 65 often lives well into their nineties or beyond. That’s thirty-plus years without a salary. Three quiet realities have broken the old calculations:

- Lifespans are much longer than previous generations expected

- Healthcare, housing, and travel costs usually rise faster than general inflation

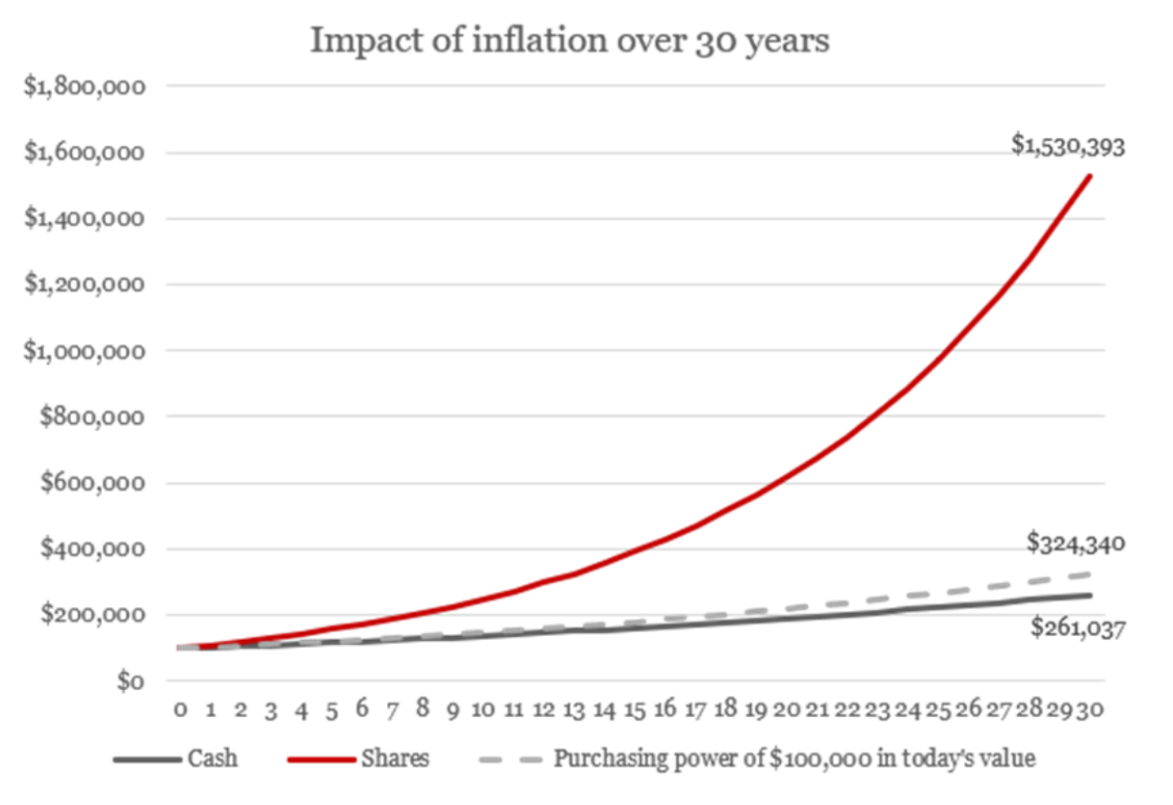

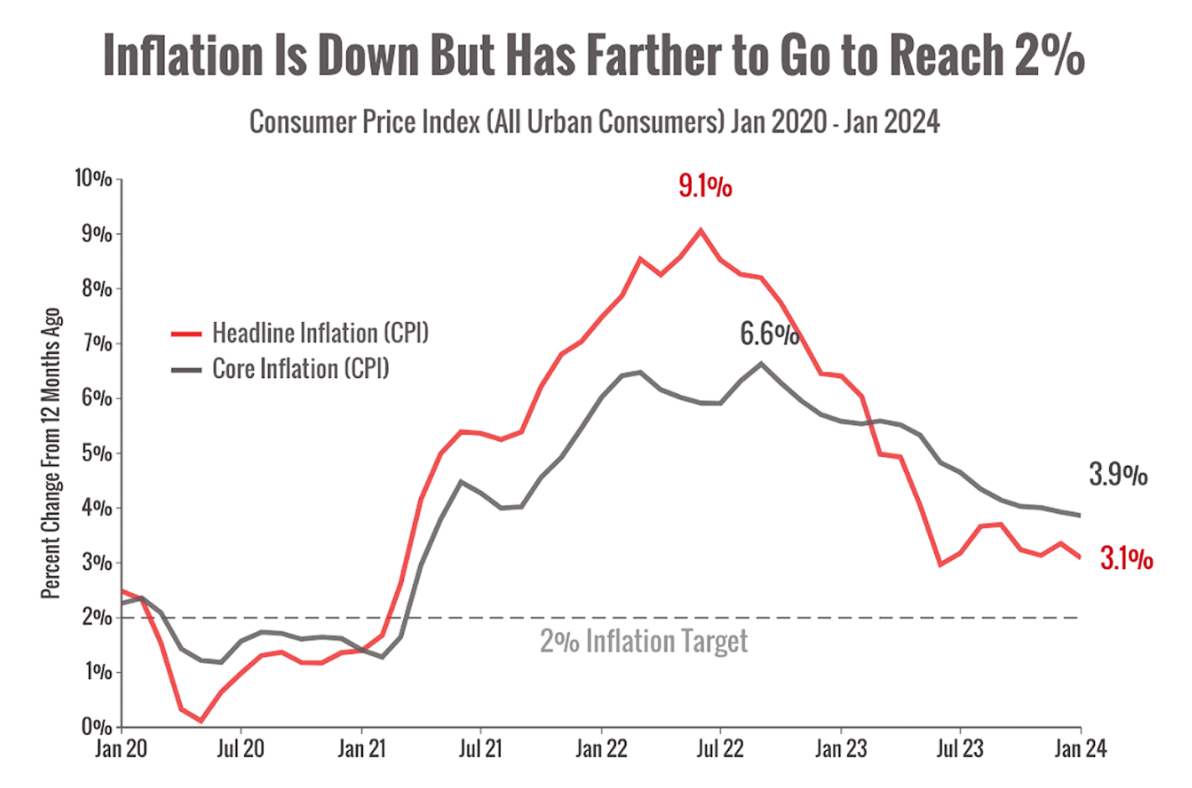

- Very safe, cash like options rarely keep up with the true cost of living over three or four decades

The result: savings that once looked comfortable can now run out a decade earlier than planned. What actually works in the new reality:

Start with the life you want.

Not a random number. Picture the monthly income you’ll need (in today’s money) and multiply by the years you might live. Most people are shocked at how large the real figure is. Then build a plan that fights inflation.

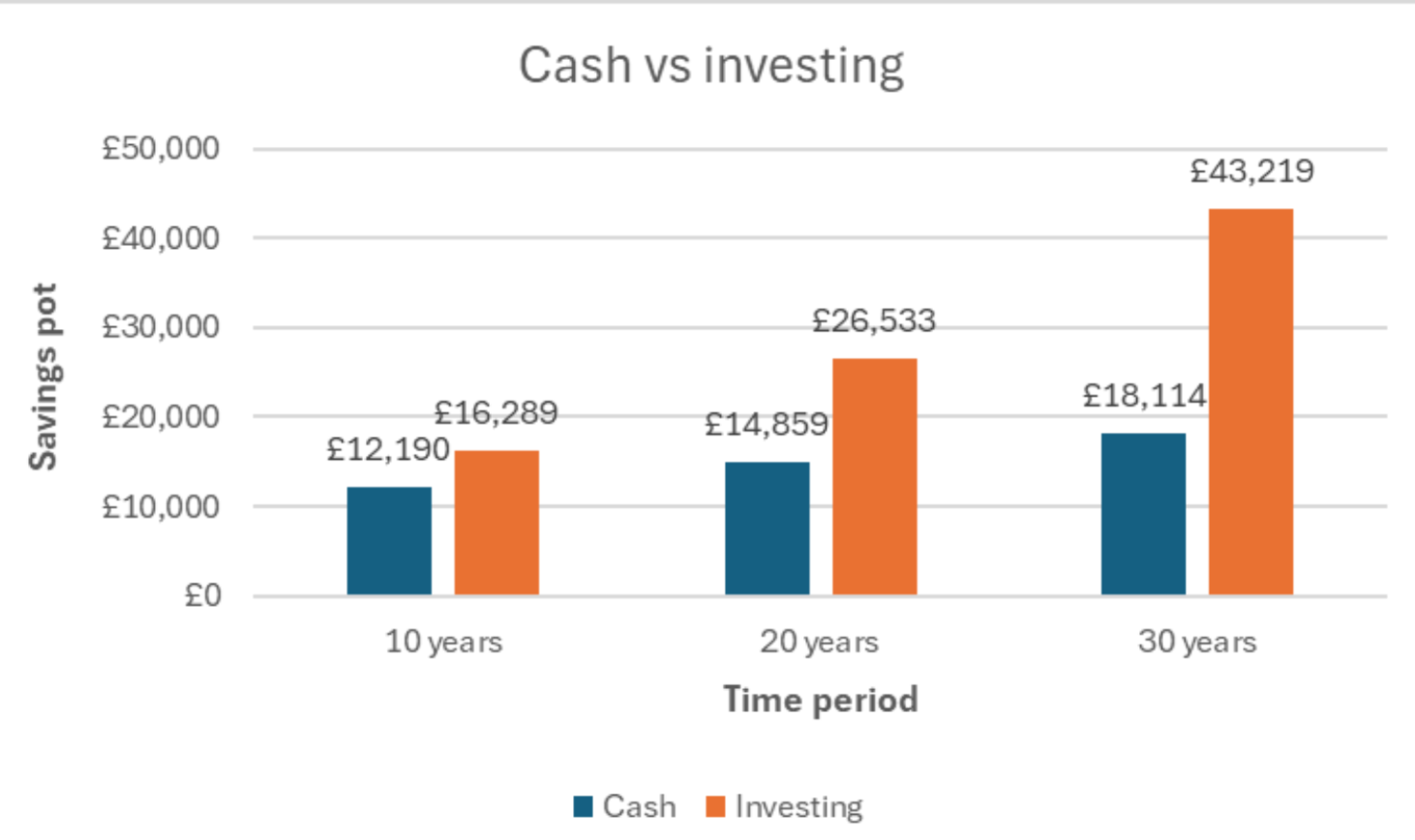

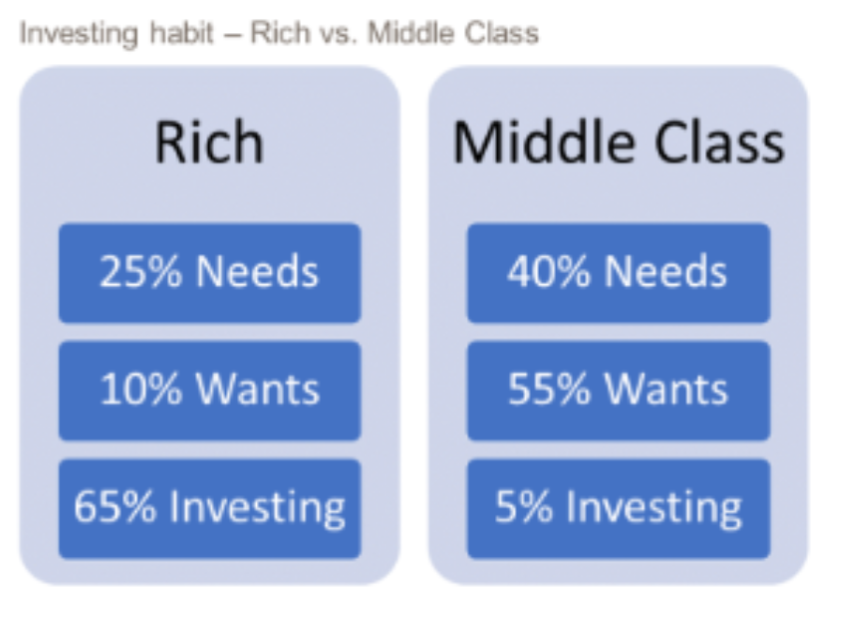

Cash and fixed deposits feel safe, but they slowly lose purchasing power. Even moderate inflation, the steady rise in prices of everyday goods, healthcare, education, and housing quietly erodes what your money can actually buy year after year. A balanced mix of growth assets (global equities, mutual funds) and income assets (dividend shares, bonds) has historically stayed ahead of rising costs.

Keep the plan alive:

- Review it every couple of years or after big life events marriage, children studying abroad, health changes, new tax rules. Small updates early prevent painful shortfalls later.

- Spread risk beyond your home country. One economy or one currency going down shouldn’t drag everything with it.

- Retirement planning is no longer “save X and you’re done.” It’s an ongoing process of keeping your money in step with the life you want to live however long that turns out to be.

Lightman Global

Thoughts on wealth topics that matter

The Hidden Cost of DIY Investing in 2026

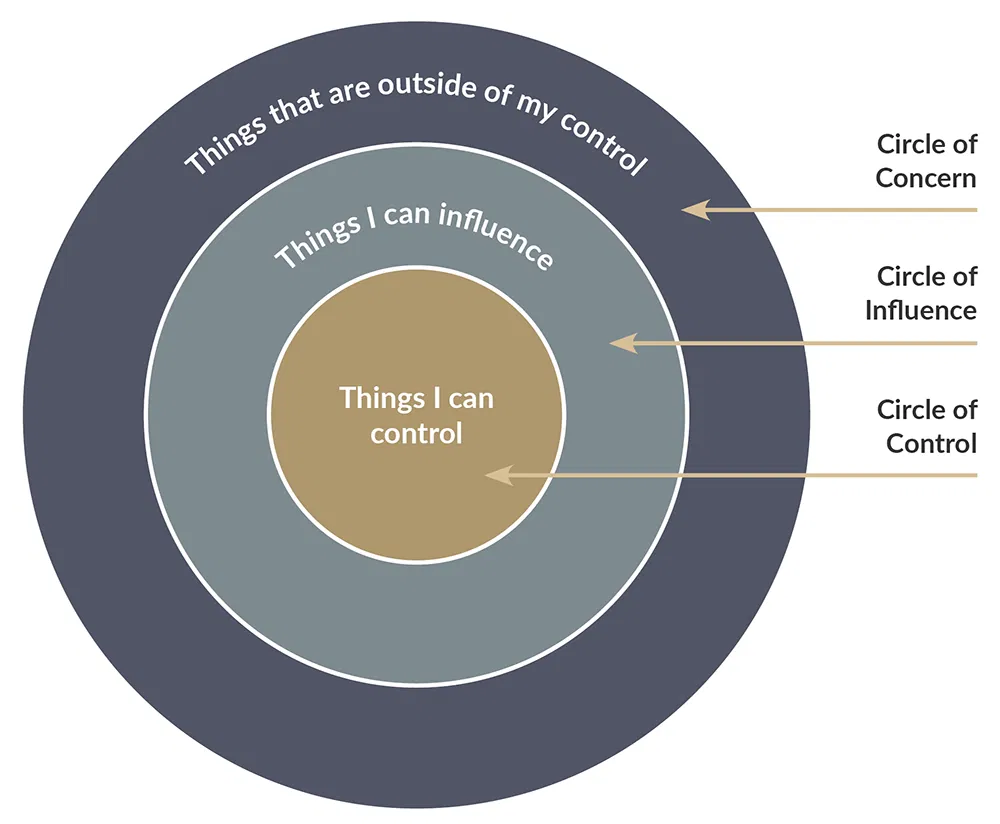

Managing your own investments feels free and completely in your control.

In reality, three invisible costs usually matter far more than any advisory fee:

- Time: A busy professional who spends ten to fifteen hours a month reading reports, checking prices, and adjusting positions is giving up time that could be spent earning, resting, or with family.

- Emotion: When markets swing wildly, the same brain that makes excellent business decisions often buys high out of excitement and sells low out of fear. Decades of studies show this single factor is the largest reason individual investors lag the markets.

- Limited view: Most people stay in assets they already understand, usually local stocks and property & miss wider opportunities and efficient structures available globally.

None of this means DIY is wrong. Some people love the process and have the discipline to follow a written system no matter what headlines say. For most high-earning professionals, however, removing the daily monitoring, second-guessing, and emotional decisions quietly improves both peace of mind and long-term outcomes. The choice isn’t about intelligence. It’s about recognising which tasks truly deserve your personal attention and which are better handled systematically.

One final hidden cost: the weight of responsibility never switches off. Even on holiday or at a family dinner, the market is always there in the back of your mind. And when life gets busy a new project, travel, and illness the portfolio is usually the first thing that gets neglected, right at the moment disciplined attention matters most.

Lightman Global

Thoughts on wealth topics that matter

Your Risk Tolerance isn't What you Think It is

Most investors say they are “moderately aggressive” or “can handle volatility.” Then the market drops 15–20% and they can’t sleep.

There are actually two very different questions:

- Ability to take risks: Your finances can survive ups and downs without changing your lifestyle.

- Willingness to take risks: Your emotions can survive ups and downs without forcing you to sell at the worst moment.

Confusing the two is the main reason people end up with portfolios that are either too timid (quietly losing purchasing power to inflation every year) or too bold (and get abandoned during the first real storm).

A proper profiling conversation separates the two.

It looks at your balance sheet, your goals, your past reactions to losses, and even how you felt during previous market drops. Most quick online questionnaires only measure ability and completely miss willingness. That’s why so many people discover their “true” risk tolerance only after the damage is done.

Willingness isn’t fixed either. It can change with age, family situation, or simply after living through a real bear market. Someone fearless at 40 may feel very different at 55 when retirement is suddenly visible.

The goal isn’t to push you toward more or less risk. It’s to build a plan that matches the lower of the two numbers, because the day you override your emotions and sell is the day the entire long-term strategy collapses. Understanding the real difference rarely feels comfortable in the moment, but it is always valuable.

A portfolio you can actually live with through every kind of market is worth far more than a theoretically perfect one you abandon when it matters most.

Lightman Global

Thoughts on wealth topics that matter

From Overwhelmed to In Control: How Goal-Based Planning Reduces Stress

Scattered accounts, unclear fees, and constant low-level worry about money are far more common than most people admit, even among those who look successful on the outside.

The turning point is usually one simple shift: stop asking “How much return can I get?” and start asking “What is this money actually for?”

When every investment is tied to a specific life goal. They could be children’s education, retirement lifestyle, buying a family home, starting a business, supporting parents, or leaving a charity legacy. Three things happen almost immediately:

- Decisions become clearer

- Random noise from markets matters less

- Regular reviews feel useful instead of stressful

A portfolio built around real goals naturally stays focused.

You sell less in panic because you remember the money is for your daughter’s university in eight years, not for reacting to today’s headline. You buy less in greed because you already know exactly how much is needed and when.

Life events still happen. A new child, a job change, an inheritance, a health scare, but instead of derailing everything, they become simple triggers to update one part of the plan rather than starting from scratch. Most people discover that the same amount of money feels completely different when it has a clear job to do.

The numbers on the statement stop being abstract; they become future memories you are quietly protecting. Peace of mind is rarely about having more money. It’s about knowing exactly why each part of your money exists and being certain it will be there when the moment arrives.

Lightman Global

Thoughts on wealth topics that matter

Why Relying Only on Local Markets Is the Silent Wealth Killer

Keeping all your investments in your home country feels familiar and safe. But in reality, it quietly concentrates risk in one economy, one currency, and one set of regulations. Local growth can be strong for years until it isn’t.

Currency weakening, political shifts, interest-rate surprises, or sector slowdowns in a single market can drag everything down at once. When your entire portfolio is tied to the same flag, there is no escape hatch.

True diversification isn’t owning twenty local funds that all move together when the local index falls.

It’s owning the world in sensible proportions: developed markets, emerging markets, different currencies, different economic cycles, different interest-rate environments.

History shows that global portfolios do two powerful things at once:

- They smooth the journey, drawdowns are usually smaller and shorter because not everything moves in the same direction at the same time

- They often deliver stronger long-term growth because you are no longer betting everything on one country’s success

Many people worry that investing globally is complicated or expensive. In practice, low-cost global funds and ETFs have made it simpler and cheaper than ever before. One passport doesn’t mean your wealth should live under the same flag. Giving your money multiple homes is one of the quietest, most effective forms of protection available.

Lightman Global

Thoughts on wealth topics that matter

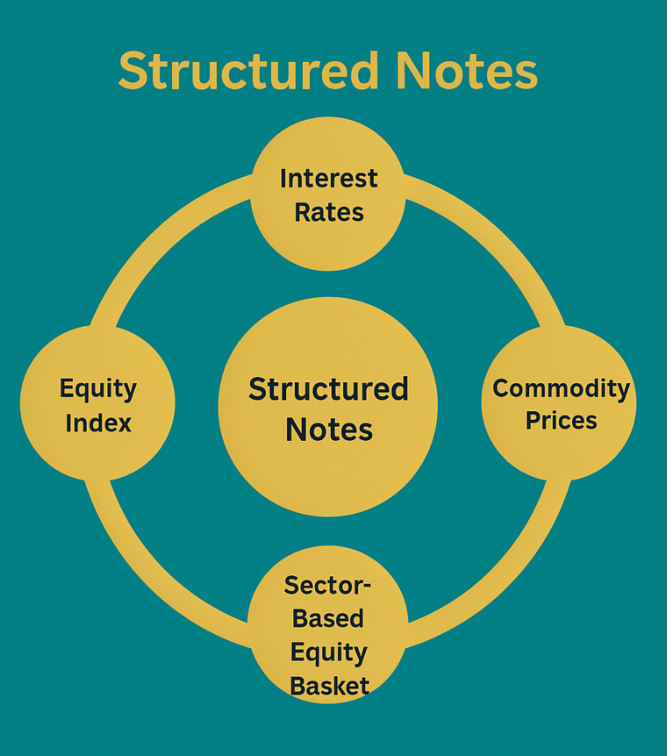

Structured Notes: When Standard Portfolios Aren’t Precise Enough

Sometimes, standard funds and ETFs can’t deliver the exact outcome you want.

Real-life examples that come up again and again:

- 100% capital protection at maturity plus full (or partial) upside to equity markets

- Returns linked directly to inflation or the price of gold instead of stock-market volatility

- A fixed buffer against the first 20–30% of losses in exchange for capping some of the gains

- Guaranteed minimum income for a set number of years no matter what markets do

Structured notes issued by major global banks can provide these precise combinations, with predefined rules written into the contract from the outset.

They are not exotic or inherently risky when used correctly; they are engineered solutions for specific jobs that ordinary funds and ETFs were never designed to do.

Think of them as custom-built tools rather than mysterious black boxes.

Everything is disclosed upfront: the exact protection level, the participation rate in upside, the issuer credit risk, the maturity date, and the early-redemption conditions.

Transparency and understanding the terms are everything.

A well-chosen note removes the guesswork from “I want growth, but I can’t afford a big loss right now” or “I need my money to keep pace with rising school fees, not just the stock market.”

Used well and only when the goal truly demands it, they add control and genuine peace of mind where off-the-shelf options inevitably fall short.

Lightman Global

Thoughts on wealth topics that matter

The Person Who Steps In Matters More Than You Think

Most investors spend decades growing their wealth. Very few decide who will protect it when they can no longer. Markets rise and fall, that’s normal.

The bigger risk often arrives later: illness, incapacity, or death, followed by forced sales at low prices, unexpected taxes, family disagreements, or simply no one knowing what you actually wanted.

A clear succession plan answers two simple question:

- Who makes decisions if you can’t?

- How should they make them?

Naming a calm, informed professional alongside (or instead of) family members keeps emotion and inexperience out of critical moments.

Someone who already understands your strategy, your risk comfort, and your long-term intentions can guide rebalancing, tax decisions, distributions, and inheritance rules when grief is highest and time is shortest.

Without this clarity, even the most sophisticated portfolio can be dismantled in weeks:

- Forced liquidation during a market dip to pay estate duties

- Family members selling what they don’t understand

- Years of careful tax planning were undone because no one knew the full picture

Years of disciplined investing can quietly disappear in months without this continuity.

Putting it in writing while everything is calm and choosing the right voice to speak for your wealth when you cannot is one of the kindest, most responsible things you can do for the people you care about most.

Lightman Global

Thoughts on wealth topics that matter

Who Will Manage Your Wealth When You No Longer Can?

Most people carefully choose their investments and advisors while they are fit and active.

Few choose who will step in if they suddenly can’t.

During a crisis or grief, financial decisions still need to be made quickly and correctly.

A loving spouse or child will naturally want to help, yet rarely has the experience to handle complex portfolios, offshore structures, tax rules, or time-sensitive choices under pressure.

Appointing someone who already knows your goals, your holdings, your risk comfort, and your values prevents costly mistakes at exactly the wrong moment.

It removes an enormous burden from family members who are already hurting.

Instead of trying to understand decades of decisions while mourning, they can simply follow a clear, pre-agreed path.

It keeps the original strategy intact instead of forcing fire sales, panicked withdrawals, or arguments about “what Dad would have wanted.”

The person who speaks for your wealth when you cannot is often more important than any single investment decision you make today.

Choosing them deliberately while everything is calm and you are thinking clearly is quiet, powerful protection for everyone you leave behind.

Lightman Global

Thoughts on wealth topics that matter

Personalisation Isn’t a Buzzword, It’s the New Standard

Generic model portfolios treat everyone the same. Your life isn’t generic. Your family situation, tax residency, concentrated stock positions from your business, ethical or religious preferences, legacy wishes, multi-country lifestyle, or the need to protect a special-needs child rarely fit neatly into the usual “conservative/balanced/ aggressive” boxes.

True personalisation starts with a blank page and your actual story, not the firm’s ready-made product shelf or a five-minute risk quiz.

When the strategy is built around the real details of your life, three things happen naturally:

- Forced liquidation during a market dip to pay estate duties

- Family members selling what they don’t understand

- Years of careful tax planning undone because no one knew the full picture

It removes an enormous burden from family members who are already hurting.

Instead of trying to understand decades of decisions while mourning, they can simply follow a clear, pre-agreed path.

It keeps the original strategy intact instead of forcing fire sales, panicked withdrawals, or arguments about “what Dad would have wanted.”

The person who speaks for your wealth when you cannot be often more important than any single investment decision you make today.

Choosing them deliberately while everything is calm and you are thinking clearly is quiet, powerful protection for everyone you leave behind.

Lightman Global

Thoughts on wealth topics that matter

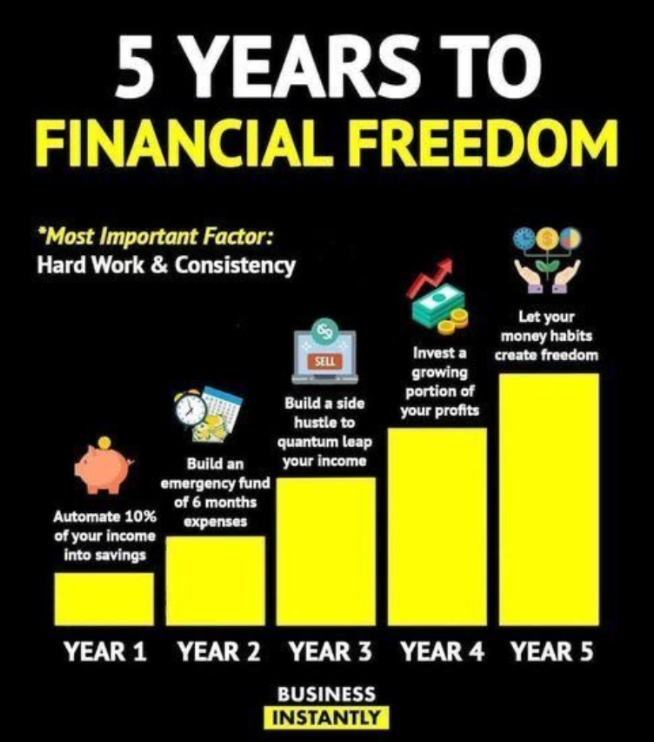

The Cost of Waiting Just One More year

Most people plan to “start seriously” next year, when the business is finally stable, the house is paid down, the children are through university, or life feels less chaotic. That single year of delay is almost never harmless. Time is the one ingredient no amount of money can ever buy back. A modest amount invested early and left untouched grows so powerfully over four or five decades that no amount of aggressive saving later can fully close the gap.

Early money has the longest runway to compound undisturbed. The first ten years do more work than the last twenty combined. Market returns are never guaranteed, but time in the market is every year you postpone is a year the market cannot work for you

Life rarely becomes quieter or cheaper; it usually becomes busier, more expensive, and full of new obligations that eat whatever surplus you thought would appear. The result: waiting until everything feels perfect almost always means starting when growth has far less time to work. What actually works is almost embarrassingly simple: begin today with whatever amount feels painless, even tiny. Automate it so it happens without thinking. Increase it gradually as income rises. Make it the first bill you pay, not the last leftover. One year of delay permanently shrinks the outcome, no matter how clever the strategy becomes later. The best time to plant a tree was twenty years ago. The second-best time is right now.

Lightman Global

Thoughts on wealth topics that matter

Why Most Wealth Is Built in Asset Classes, Not Exciting Ones

Everyone remembers the dramatic years, the crashes, the bubbles, the 2020 pandemic drop, and the 2022 inflation scare, because they dominate headlines, dinner conversations, and social media. Yet when you pull up any long-term chart of real wealth, the vast majority of the upward line was drawn during the quiet, slightly positive, forgettable years that barely made the news at all.

Long stretches of calm let compounding run uninterrupted for years at a time, no forced withdrawals, no panic selling, no emotional resets. Boring years are when valuations slowly return to reasonable levels after previous excitement, setting the foundation for the next genuine advance.

Patient investors quietly buy more shares at fair prices while everyone else is bored, distracted, or waiting for the “next big thing” to happen The investors who end up far ahead are almost never the ones who correctly called the top or the bottom. They are the ones who stayed fully invested through decade after decade of “nothing much happening “the years when the market went up modestly, volatility was low, and financial television had nothing exciting to discuss. Those unremarkable periods are where the mathematical magic quietly takes place. Drama gets the attention. Boring gets the money.

Lightman Global

Thoughts on wealth topics that matter

The Family Conversation No One Wants to Have (But Everyone Needs)

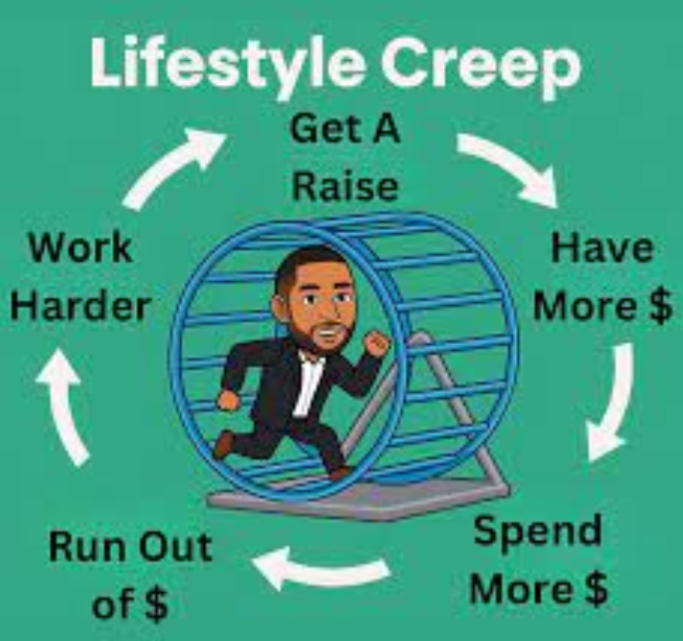

Income rises, spending quietly rises to match a better car, a bigger house, international schools, luxury holidays, and helping relatives. Each upgrade feels fully justified and becomes the new permanent baseline within months. Three silent consequences appear over a decade:

- Where important documents are kept and who can access them

- Basic wishes for medical care and financial decisions

- Chosen guardians for children and trusted voices for wealth

- Open sharing of goals so the next generation understands the “why” behind the plan .

Spouses gain clarity instead of facing impossible choices alone. Parents discover what actually matters to their children often very different from what they assumed. Relationships stay protected because resentment and misunderstanding never get space to grow. A single difficult hour today can preserve both wealth and family harmony for decades tomorrow.

Lightman Global

Thoughts on wealth topics that matter

The Hidden Risk of Lifestyle Creep

Talking about money, illness, death, and “what happens if” feels awkward while everyone is healthy and life is good. Avoiding it guarantees pain when emotions are highest and time is shortest. One calm conversation that covers four simple areas changes everything:

- The surplus that once existed has vanished

- The lifestyle now feels exactly the same only far more expensive

- Financial freedom keeps moving further away despite higher earnings.

The most effective long-term wealth builders treat lifestyle increases as rare, deliberate choices rather than automatic ones. They raise their standard of living far more slowly than their income sometimes barely at all for many years and watch the growing gap compound into genuine freedom. Lifestyle creep is the single largest reason high earners stay on the treadmill forever.

Lightman Global

Thoughts on wealth topics that matter

Why Your Circle Quietly Shapes Your Wealth

The five or ten people you spend the most time with slowly, invisibly set the standard for what feels “normal” when it comes to money, how much is saved, how much is spent, how patient you are, and how you talk about wealth. Three ways this happens without anyone noticing:

- Conversations about money become either completely natural and open, or completely off-limits and awkward, depending on the group.

- Friends’ choices cars, schools, holidays, homes, watches quietly become the benchmark for what you start to see as reasonable or necessary

- Attitudes toward delayed gratification, risk, and long-term thinking rub off more powerfully than any book, podcast, or seminar ever could surround yourself with people who value building over showing, freedom over status, and patience over flash, and your own behaviour shifts in the same direction almost automatically.

Conversely, a circle that celebrates immediate consumption and visible success makes disciplined wealth-building feel strange, unnecessary, or even greedy. Your network is one of the few things that compounds even faster than money, and unlike market returns, you have almost complete control over who is in it.

Lightman Global

Thoughts on wealth topics that matter

Building a Portfolio You Won’t Abandon at the Worst Moment

We’ve all seen the headlines: spectacular returns one year, sharp drawdowns the next. The truth is this: the perfect portfolio on paper is worthless if you can’t live with it when markets drop sharply. Most investors abandon their plan exactly when patience would have paid the highest reward.

Complex strategies, frequent trading, and products you don’t fully understand feel great during rallies, but they break confidence when volatility returns. At the worst moments, investors make the worst decisions, not because the strategy was flawed, but because it didn’t fit them. Here’s what many investors miss:

A good-enough plan you follow for thirty years almost always beats a brilliant one you bail out of after eighteen months. The goal is never to be the smartest in the room. It’s to be the one still calmly invested when the storm finally passes.

- Simplicity - You must understand every holding completely. If you can’t explain why it’s there, it probably shouldn’t be.

- Transparency - No mysterious products. No hidden fees. No surprises. You should know what you’re invested in and why.

- Emotional and Financial Alignment - Your portfolio must reflect your true risk tolerance, life goals, and time horizon. Not your theoretical comfort on a spreadsheet.

At Lightman Global, we focus on building portfolios that withstand emotional stress and market volatility. Not just chase the latest performance stats. If you want a strategy that fits your temperament and keeps you invested through downturns, let’s talk.

Lightman Global

Thoughts on wealth topics that matter

The One Decision That Matters More Than Any Single Investment

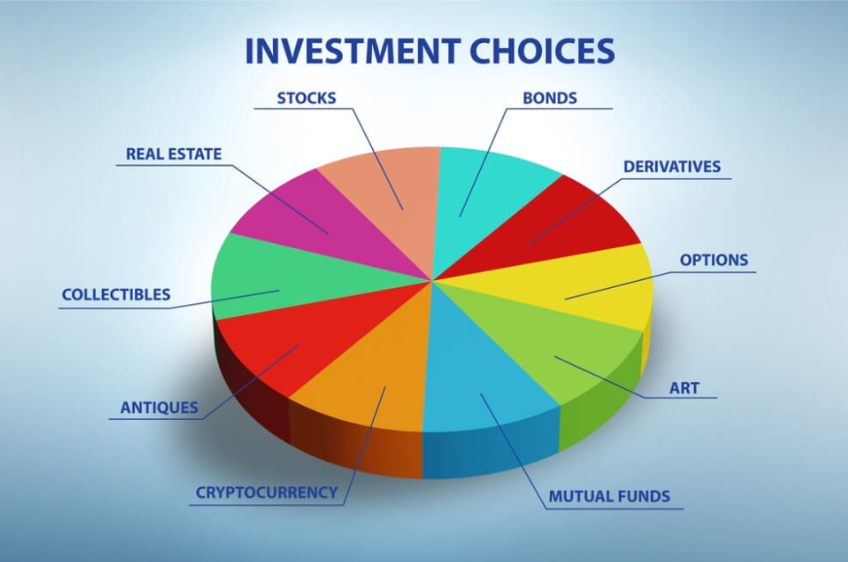

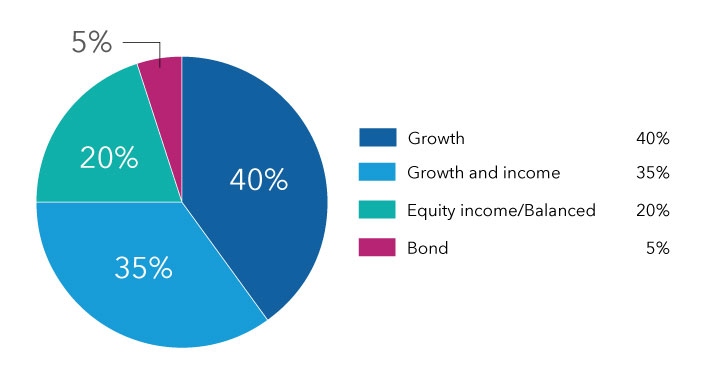

When it comes to long-term investing, many investors obsess over picking the “best” stock or fund. But the single most important decision you will make isn’t which ticker to buy. Academic research and industry studies consistently show that asset allocation explains the vast majority of long-term investment outcomes. The mix between major asset classes largely determines the portfolio’s risk-return profile, far more than individual security selection or tactical timing.

Here’s how it works in practice:

- It determines how much volatility you actually experience. A portfolio heavy in equities will swing more sharply than one balanced with bonds and alternatives, which directly affects investor behaviour and decision-making in downturns.

- It sets the expected growth rate over decades. The strategic balance between higher-growth assets and more stable income-generating ones largely drives long-term compound returns.

- It decides how well you sleep during storms. If your allocation doesn’t fit your risk tolerance, you’re far more likely to make emotional decisions at the worst times.

Once you get your core allocation aligned to your age, goals, and emotional tolerance, almost everything else becomes detail. Individual stock picks, sector bets, and short-term market views ride on top of this foundational decision. Research shows they explain only a small fraction of return variability compared with the allocation itself.

If you’re serious about long-term wealth building, focus first on getting the broad mix right. That means assessing:

- Your timeline (long vs. short term)

- Your comfort with market drops

- Your financial goals (growth, income, legacy)

A thoughtful asset allocation isn’t static; it evolves as life changes. But getting this core decision right from the outset increases the likelihood you’ll stay invested through thick and thin. And achieve your financial goals without abandoning your plan at the worst moment!

Lightman Global

Thoughts on wealth topics that matter

The Difference Between Activity and Progress

Checking prices every morning, reading endless research, switching funds, chasing the newest theme, and constantly tweaking the portfolio feel intensely productive. In reality they are almost always just motion disguised as progress. Three clear signs you’re stuck in activity instead of actually moving forward:

The portfolio changes frequently, but the long-term upward trajectory stays flat or barely moves. Time spent on investing keeps growing while the actual growth of wealth does not.

Decisions are driven by recent headlines, social-media noise, or the latest hot story instead of a written plan made years earlier on a calm day. The wealthiest investors you will never hear about do dramatically less than everyone else because they decided long ago what truly matters and ignores almost everything else. They rebalance once or twice a year, add fresh money on a fixed schedule, and let the rest run undisturbed. Real progress in wealth-building is quiet, repetitive, boring, and usually invisible for years at a time. Activity feels good today. Progress feels good decades from now.

Lightman Global

Thoughts on wealth topics that matter

The Power of Doing Nothing (At the Right Time)

The urge to act, buy, sell, switch and tinker is strongest when markets are most emotional. Volatility creates a feeling that you must respond that movement equals control, and that doing something is safer than staying still. Yet doing nothing is often the highest-conviction decision available, and also the hardest to execute when pressure is high. In moments of uncertainty, the discipline to remain steady becomes a real advantage, especially when everyone else is reacting to headlines, noise, and short-term swings.

Three things make inaction powerful:

- A clear written policy created years earlier removes the need to decide in the moment. When your long-term allocation, risk tolerance, and rules are already defined, market conditions don’t force you into emotional choices. The plan decides, not the mood of the day

- Avoiding transaction costs and taxes that quietly eat returns. Constant activity feels productive, but it often reduces performance through fees, spreads, and taxable events that compound negatively over time. Staying still can be the most efficient choice financially.

- Letting long-term compounding continue undisturbed. The real engine of wealth works best when untouched. Interrupting it repeatedly for short-term reactions can do far more harm than market volatility itself. Time in the market, not timing the market, remains the most consistent advantage investors have.

The investors who win the biggest are frequently the ones who turned off notifications, went on holiday, and simply let their original plan run. They trusted the strategy they built when they were calm rather than the instincts that surface during stress. Sometimes the most active thing you can do is absolutely nothing, and learning to be comfortable with that is a skill that separates long-term success from short-term noise.

Lightman Global

Thoughts on wealth topics that matter

The 7 Levels of Financial Freedom

Everyone wants financial freedom, but few understand what it really means or how to achieve it. Financial freedom isn’t an all-or-nothing state. It’s a journey with distinct levels that reflect how secure, stress-free, and empowered you are with your money. Understanding these stages can help you set practical goals and track real progress.

Most investors fixate on returns or the “next big investment.” But your stage of financial freedom should drive your strategy:

Early levels focus on cash flow, budgeting, and eliminating bad debt. Middle levels emphasize risk management and savings discipline.Advanced levels require wealth preservation, tax efficiency, and legacy planning.

- 1. Clarity(Know Where You Stand): The first step is simply understanding your financial picture. This means knowing your income, expenses, debts, and goals. Without clarity, it’s impossible to take purposeful action. Define what freedom means to you before chasing it.

- 2. Self-Sufficiency(Cover Your Own Expenses): At this level, you’ve gained independence from financial dependency. You can pay your bills, support your lifestyle, and manage your everyday costs without relying on others. This is the foundation of long-term financial health.

- 3. Breathing Room(No Longer Living Paycheck-to-Paycheck): Once you begin saving consistently, you move into “breathing room.” You’re no longer scrambling each month to meet commitments. You’re building a cushion that reduces stress and gives you options.

- 4. Stability(Emergency Buffer and Debt Control): Stability means you have no bad debt and at least six months of expenses saved. At this stage, you can weather unexpected setbacks, which are job changes, medical bills, or market dips, without derailing your long-term plan.

- 5. Flexibility(Time and Choice): With at least two years of expenses saved and diversified assets, you gain real flexibility. You could take a sabbatical, shift careers, or pursue a passion project - without financial fear. This is the bridge between security and true independence.

- 6. Financial Independence(Live Off Investment Income): Here’s where money starts to truly work for you. Your investments generate enough income to cover your lifestyle. You no longer need earned income to sustain your standard of living. Work becomes a choice, not a requirement.

- 7. Abundant Wealth(More Than You’ll Ever Need): The final level means you have more than enough when it is for your lifestyle, your legacy, and to make an impact. Money stops being a constraint and becomes a tool to shape the life you want and empower others.

How We Help You Advance

At Lightman Global, we tailor strategies to where you are today and where you want to be tomorrow. Whether you’re building breathing room or aiming for financial independence, we craft plans that match your goals and risk tolerance.

Start your journey toward financial freedom today. Contact us for a personalized roadmap that grows with you.

Lightman Global

Thoughts on wealth topics that matter

Why “Put-Us-on-Your-Side” Fees Are Better And Why AUM Works for You

When a financial adviser charges a fee based on assets under management (AUM) such as 2% annually the arrangement isn’t just billing mechanics. It’s a structure that aligns the adviser’s incentives with your own success.

A fee based on AUM grows or shrinks with your portfolio. That means your adviser has a vested interest in seeing your investments perform well, keep growing, or at least staying diversified and stable. This alignment encourages long-term thinking: rebalancing, minimizing unnecessary risk, and tailoring a portfolio to your goals, rather than chasing quick commissions or pushing one-size-fits-all products.

Moreover, with an AUM fee structure you benefit from ongoing support, not a one-time plan. Your adviser remains engaged: monitoring performance, recommending adjustments, handling trades, overseeing custody and compliance, and delivering transparent reporting all under a regulated framework.

Charging a fixed percentage also simplifies the cost structure. You know going in that you’ll pay a clear, predictable portion of what’s managed, avoiding hidden commissions or incentive-driven product pushes.

Finally, for clients with a moderate-to-sizable portfolio, an AUM fee often becomes more cost-efficient over time than flat or hourly fees especially when factoring in the value of continuous, proactive portfolio oversight and peace of mind that comes with delegating complex investment operations.

In short: when you pay based on what actually matters your assets the financial adviser’s incentives and your outcomes move in tandem. That alignment, transparency, and ongoing commitment make AUM-based fees a compelling choice for clients serious about long-term wealth management.

The One Habit That Separates Wealthy Families From Everyone Else

Most people keep 12–24 months of living expenses in cash or near-cash “just in case”. It feels safe and responsible especially after uncertain times. Yet for the vast majority, that much cash is not protection. It is quietly one of the biggest barriers to real financial freedom. Cash beyond true emergencies is the most expensive luxury you can own because it costs you growth you can never get back.

What is “Truly Enough”?

For almost everyone, 6 months of core living expenses is the sweet spot. Why 6 months? It covers most real emergencies: job loss, health issues, family crises, major repairs. Most professionals find new work within 6 months, even in tough markets. It gives breathing room without tying up money meant for the future.

Some need 9–12 months freelancers, business owners, or single-income families with high fixed costs. Anything beyond 12 months is rarely an emergency fund.It is a comfort fund and comfort has a high price. Why too much cash quietly costs freedom:

Opportunity cost money earning 3–5% while inflation runs 5–7% loses purchasing power every year

Delayed independence excess cash delays the day your investments cover lifestyle, keeping you working longer. Feeds fear hoarding cash trains the brain to fear volatility, the price of long-term growth. The people who reach freedom fastest keep just enough cash for real shocks and put everything else to work in growth and income assets.They sleep well protected from short-term problems and positioned for long-term choices.

Cash is for today. Investments are for tomorrow.

Keep enough to feel safe. Not so much that it quietly steals your future.

Lightman Global

Thoughts on wealth topics that matter

Financial Independence Doesn’t Mean Living on Rice and Beans

Retire early stories focus on sacrifice – extreme budgets, no dining out, second-hand everything, denying joy until “freedom” arrives. The balanced path is different and far more common among those who actually succeed long-term.

Three principles make it work:

- High savings rate without cutting joy - save 50%+ by earning more and spending intentionally, not by denying everything that makes life enjoyable

- Growth investments that compound while you live normally - diversified assets that grow faster than your spending, working in the background

- Clear “enough” number that allows spending guilt-free on what matters - travel, family, experiences - without endless chasing or fear of running out

Wealth is for living – today and tomorrow. Many fail at extreme frugality because it’s unsustainable – burnout, resentment, quitting the plan altogether. The balanced approach builds wealth faster because you stick to it for decades, enjoying the process instead of enduring it. Enjoy the journey: good food, meaningful travel, time with loved ones – while the investments work in the background quietly.

Financial independence is not about how little you can live on. It is about how much freedom you can create while still living well – options, choices, peace of mind. The people who reach it smiling are the ones who never felt deprived along the way.

Lightman Global

Thoughts on wealth topics that matter

How Much Cash Is Too Much in Your Bank Account

Cash feels safe, liquid, and comforting especially after a market scare or uncertain times. Too much of it quietly becomes the biggest drag on long-term wealth most people never notice.

Three signs you have crossed the line from prudent to counterproductive:

- More than 12–18 months of living expenses sitting idle earning almost nothing

- Cash returns consistently below inflation, slowly losing purchasing power every year

- The “just in case” pile keeps growing while growth assets stay small or non-existent

The people who actually get wealthy treat raises as fuel for the future, not permission for today. They lock in the old spending level and direct the new money straight to growth assets, retirement funds, investment accounts, debt payoff. A salary increase only makes you richer if your invested balance grows faster than your spending.

Otherwise it is just a more expensive version of the same life, same stress, same treadmill, just with nicer scenery. Many high earners discover too late that their take-home grew, but their freedom didn’t. They work harder for more money that disappears faster.

The quiet shift: view every raise as “future me’s salary increase”. Keep living on the old level. Let the new level build the life you won’t have to work for later.

One decision repeated over years turns good income into real wealth.

Lightman Global

Thoughts on wealth topics that matter

Financial independence is not about how little you can live on. It is about how much freedom you can create while still living well – options, choices, peace of mind. The people who reach it smiling are the ones who never felt deprived along the way.

Lightman Global

Thoughts on wealth topics that matter

Why Your Salary Increase Is Making You Poorer

A big raise or bonus feels like real progress, more money, more options, finally breathing room after years of tight budgeting. Yet for most people it quietly makes them poorer in the long run.

Three ways this happens without noticing:

- Lifestyle quietly upgrades to the new income level within months bigger home, better car, private schools, luxury holidays, helping family more generously

- Taxes take a larger bite at higher brackets, eating a bigger share than expected and leaving less “extra” than the headline number suggested

- The gap that once built wealth gets filled with “deserved” extras instead of investments the surplus that used to go to savings or growth now funds the new normal

The people who actually get wealthy treat raises as fuel for the future, not permission for today. They lock in the old spending level and direct the new money straight to growth assets, retirement funds, investment accounts, debt payoff. A salary increase only makes you richer if your invested balance grows faster than your spending.

Otherwise it is just a more expensive version of the same life, same stress, same treadmill, just with nicer scenery. Many high earners discover too late that their take-home grew, but their freedom didn’t. They work harder for more money that disappears faster.

The quiet shift: view every raise as “future me’s salary increase”. Keep living on the old level. Let the new level build the life you won’t have to work for later.

One decision repeated over years turns good income into real wealth.

Lightman Global

Thoughts on wealth topics that matter

Why Your Salary Increase Is Making You Poorer

It is not market crashes, bad investments, or economic downturns. It is the slow, daily leak of small, unconscious spending that feels too tiny to matter in the moment coffees, subscriptions, impulse buys, “small treats”, extra delivery fees.

Three ways it kills wealth quietly over time:

- Daily coffees, subscriptions, impulse buys, and “small treats” add up to hundreds of thousands over decades the same amount that could have compounded into real freedom

- Small leaks compound just like investments only in reverse, draining what could have grown into significant wealth if directed to growth assets

- They train the brain to see money as something that flows out easily, not something that stays and multiplies creating a habit of spending first and saving last

Most people never notice because the amounts are small and feel harmless. A $5 coffee, $10 subscription, $20 impulse buy each one is “nothing”. Over 30 years, that “nothing” becomes everything. The fix is simple but powerful: track every expense for three months, not to cut everything, but to see where money is actually going.

Use an app, a notebook, or a simple spreadsheet record every single dirham spent. Most people discover thousands disappearing on things they barely remember buying or enjoying. Some are surprised at how much goes to subscriptions they forgot about, delivery fees they never tracked, or daily habits they thought were “cheap”.

Once you see the leaks clearly, plugging them becomes effortless not deprivation, just redirection. The money saved doesn’t vanish; it goes straight to growth assets that compound over time.

The big ship sails much further with the same wind when the small holes are sealed.

Lightman Global

Thoughts on wealth topics that matter

The Correlation Between Financial Literacy and Wealth

In today’s complex financial world, income alone doesn’t determine long-term financial success. Financial literacy is the ability to understand and apply financial concepts like budgeting, saving, investing, and debt management. It has a proven connection to wealth accumulation. Understanding this link can help individuals make better financial choices and build wealth over time.

Research finds that individuals with higher financial literacy tend to accumulate more wealth than those with lower financial knowledge. Studies show that financial literacy has a strong positive association with household net wealth, including pension savings, housing wealth, and other financial assets. Evidence further confirms this link: higher financial literacy predicts greater income and increased savings over time, which directly contributes to wealth accumulation.

You ask how? Financial literacy matters because it influences how people behave with money. Those who are financially literate are more likely to:

- Save consistently and plan for retirement, recognising the power of compound interest and long-term investing.

- Manage debt responsibly, avoiding high-cost borrowing that erodes net worth.

- Make informed investment decisions, choosing appropriate asset allocation and participating in markets confidently.

Financial literacy doesn’t just improve individual financial outcomes – it empowers people to make decisions that build and protect wealth. Rather than reacting emotionally to market swings or borrowing impulsively, financially literate investors plan, diversify, and act with clarity. This consistently leads to better long-term outcomes and greater financial stability.

However, the relationship can be bidirectional: higher wealth can also motivate increased financial learning, as people with more resources have greater incentive and access to financial education.

Take the Next Step. At Lightman Global, we believe knowledge is the foundation of long-term financial success. We help clients not only build wealth through disciplined investing but also deepen their financial understanding so they can make confident, informed choices at every stage of their journey.

Contact us to explore how enhancing your financial literacy can help you grow and protect your wealth over the long run.

Lightman Global

Thoughts on wealth topics that matter

Investing Like a Woman vs Investing Like a Man

Decades of research from brokerages, academics, and funds shows one clear pattern: women investors, on average, outperform men over long periods by 1–2% per year. The reason is not superior skill or secret knowledge, it is superior behaviour that compounds quietly.

Three differences explain the gap:

- Women trade less frequently, avoiding transaction costs and timing mistakes that eat returns year after year

- Women ask more questions, research more thoroughly, and commit only when comfortable leading to better-informed decisions

- Women stay invested through volatility instead of reacting emotionally to short-term noise or headlines

Men tend to chase performance, overtrade, take bigger risks for bigger rewards, and sometimes get them but more often underperform because of overconfidence and ego-driven moves. The “female” approach is not about gender, it is about patience, discipline, and avoiding unnecessary risks that destroy compounding.

Anyone can adopt it and quietly come out ahead over decades. The key insight: less action, more thought, and steady holding beats constant movement every time. Women’s lower trading frequency alone saves thousands in fees and taxes, while their patience lets winners run and losers recover. Men’s higher trading often turns good investments into average ones through costs and bad timing.

The lesson is simple: slow and steady wins the wealth race.

Copy the habits. Trade less, research more, stay invested and the results follow naturally.

Lightman Global

Thoughts on wealth topics that matter

The Weekend Test: Is Your Money Working Harder Than You?

Come Monday morning, ask one simple question: did my money earn anything while I was resting, sleeping, or with family? If the answer is “no” or “almost nothing”, the weekend was wasted for your wealth.

Three ways to pass the test consistently:

- Growth assets that rise over time even when you are asleep or on holiday equities and funds that compound quietly

- Income assets that pay dividends or interest automatically into your account bonds, dividend stocks, or funds that generate cash flow without effort

- A system that adds fresh money on schedule without weekend effort or decisions automated contributions that happen regardless of your attention

The goal is not to work harder yourself. It is to build a portfolio that works when you don’t. Money that rests on weekends is money that never gets ahead of inflation or life’s rising costs. Most people’s money sleeps when they do flat in cash or low-return accounts. The wealthy make sure their money never stops working, earning, growing, or paying income 24/7. The weekend test is a quick reality check. If your money failed, it’s not too late to change the setup.

Start small: move some cash to growth assets, set up automatic transfers, choose income-generating holdings.

Over years, weekends become the time your wealth grows most because you’re not watching it.

Lightman Global

Thoughts on wealth topics that matter

Why Your Parents’ Financial Advice Is Keeping You Broke

Your parents meant well: save first, avoid debt, buy property early, keep cash safe, work hard for promotions. That advice worked beautifully in their world of high interest rates, low inflation, rising property prices, and stable jobs. Three realities make it dangerous today:

- Safe returns are now below inflation in most countries, quietly eroding money instead of growing it. Cash that once earned real returns now loses purchasing power every year

- Property no longer guarantees strong growth after maintenance, taxes, and opportunity cost.

- Waiting to “save enough” before investing leaves the most valuable ingredient i.e. time on the table, & missing decades of compounding

Their rules kept them secure in their era. Following them blindly today quietly erodes wealth in ours. Many high earners stay stuck because they follow “safe” advice that no longer matches reality. They save diligently, buy the house, avoid “risky” markets – and wonder why freedom never arrives. Honour the intention – discipline, caution, long-term thinking. Update the execution for the world we actually live in: save and invest early, use good debt wisely, diversify globally.

The old rules built middle-class security. The updated version builds real wealth.

Lightman Global

Thoughts on wealth topics that matter

The 5 Year Rule That Changes How You Spend Every Dirham

Before any purchase – big or small – ask one question: will I care about this in five years? Three outcomes usually appear immediately:

- Most daily spending fails the test and quietly disappears from the cart - coffees, gadgets, clothes that feel essential today but forgotten tomorrow

- Big purchases that pass become deliberate, joyful, and truly appreciated - things that add real value to life, family, or future goals

- Money saved from failed items goes straight to long-term growth instead of consumption - redirected to investments that compound quietly

Five years from now you will thank today’s version of yourself for every “no” you said to the unimportant and every “yes” to what lasts.

The rule is not about deprivation or minimalism. It is about directing money toward things that actually matter long-term, whether experiences, freedom, or legacy. Many people spend freely on the moment and wonder why wealth never grows. The 5-year question flips that, it makes spending intentional and saving automatic. Over time, the small “no’s” add up to big “yes’s”. More freedom, less regret, stronger finances.

Lightman Global

Thoughts on wealth topics that matter

When to Stop Listening to Financial “Experts”

Financial media, newsletters, influencers, hot tips, and endless opinions are everywhere – louder than ever. Listening to too many voices creates paralysis, constant second-guessing, and frequent changes that destroy long-term results.

Three signs it is time to tune out and trust your own plan:

- You change strategy more than once a year based on the latest “must-know” prediction or trend

- Your portfolio reflects recent headlines instead of your written goals from years ago, & drifting with the noise

- You feel anxious about money despite being on track by any reasonable measure. Returns are solid, goals progressing, but the noise makes you doubt

The best investors have one clear, simple plan they follow quietly – and they ignore almost everything else. Expert noise is entertainment for most and distraction for all. It sells clicks, subscriptions, and fear – not better outcomes. Your plan – built when calm, aligned with your goals, risk tolerance, and life – is progress.

Tuning out doesn’t mean ignoring the world. It means checking your plan once or twice a year, adjusting only for life changes, and letting time do the work. The quiet ones who stick to their path end up far ahead.

Turn down the volume. Trust what you built.

Lightman Global

Thoughts on wealth topics that matter

Why Your Emergency Fund Is Probably Too Big (And What to Do Instead)

Most people keep far more cash in their emergency fund than they actually need. It feels safe and responsible especially after a job scare or global uncertainty. Yet an oversized emergency fund is quietly one of the biggest drags on long-term wealth.

Three realities make “too big” more common than you think:

- Many aim for 12–24 months of expenses, far beyond what covers real emergencies

- Cash returns almost always lag inflation, slowly eroding purchasing power

- Excess liquidity delays the day your investments produce enough to cover life

The result: short-term safety stays intact, long-term freedom arrives sooner.

What is truly enough? For most, 6 months of core living expenses is the sweet spot covering job loss, health issues, or major repairs without tying up growth money. Freelancers or single-income families may need 9–12 months. Anything more is not protection. It is comfort at a high price. What to do instead? Keep the true emergency portion liquid, then move the rest to growth and income assets that beat inflation over time.

Lightman Global

Thoughts on wealth topics that matter

How Much Cash Is Truly Enough And Why Parking Too Much There Quietly Costs You Freedom

Most people keep 12–24 months of expenses in cash or near-cash “just in case”. It feels safe and responsible especially after uncertain times like pandemics, recessions, or personal setbacks. Yet for the vast majority, that much cash is not protection. It is quietly one of the biggest barriers to real financial freedom. Cash beyond true emergencies is the most expensive luxury you can own because it costs you growth you can never get back.

What is “truly enough”? For almost everyone, 6 months of core living expenses is the sweet spot. Why 6 months? It covers most real emergencies: job loss, health issues, family crises, major repairs, or unexpected travel.

Most professionals find new work within 6 months, even in tough markets. It gives breathing room without tying up money meant for the future. Some need 9–12 months freelancers, business owners, or single-income families with high fixed costs or less predictable earnings.

Anything beyond 12 months is rarely an emergency fund. It is a comfort fund and comfort has a high price. Why too much cash quietly costs freedom:

- Opportunity-cost: Money earning 3–5% while inflation runs 5–7% loses purchasing power every year, meaning tomorrow’s lifestyle costs more than today’s.

- Delayed independence excess cash delays the day your investments cover lifestyle, keeping you working longer than you need to.

- Feeds fear hoarding cash trains the brain to fear volatility, the price of long-term growth, and makes moving money into investments feel scarier than it is.

The people who reach freedom fastest keep just enough cash for real shocks and put everything else to work in growth and income assets that compound quietly. They sleep well protected from short-term problems and positioned for long-term choices.

Cash is for today. Investments are for tomorrow. Keep enough to feel safe.

Lightman Global

Thoughts on wealth topics that matter

The One Money Habit That Separates Wealthy Families from Everyone Else

Wealthy families do not earn dramatically more or invest in secret strategies nobody else knows about. They share one quiet habit almost nobody else follows consistently. They treat money conversations as normal family conversations – open, regular, and starting from an early age. Three ways this habit changes everything over generations:

- Children grow up seeing money as a tool to be understood, not a mystery or something shameful to avoid discussing - leading to better decisions later in life

- Spouses stay perfectly aligned on goals, spending, and legacy instead of discovering painful differences too late in life - preventing drift or conflict

- Decisions about giving, inheritance, and family support are made calmly over years, not in emotional crisis after someone is gone - catching mistakes early

The result: mistakes are caught early, resentment never builds, and wealth survives generations instead of disappearing in one. One simple dinner-table discussion every few months – about goals, progress, and “why we do things this way” – is worth more than any complex financial product or hot investment tip. Most families avoid money talk because it feels awkward or private. Wealthy ones make it routine, like discussing holidays or school.

The difference is profound – ordinary income becomes generational wealth through alignment and understanding.

Lightman Global

Thoughts on wealth topics that matter

One Simple Routine That Turns Ordinary Income into Generational Wealth

The biggest difference between families that build lasting wealth and those that don’t is not higher salaries or clever investments. It is one simple routine: regular, open family money conversations. Three ways it works quietly:

- Everyone understands the plan, so mistakes are caught early and small problems never grow into big ones that erode wealth

- Children learn responsibility and values around money from real examples, not lectures or surprises later in life - preparing them to manage and grow it

- Goals stay aligned as life changes, preventing drift or conflict that quietly erodes wealth over time through misaligned decisions

Most people assume wealth comes from earning more or finding the “right” investment. In reality, ordinary income – handled with this routine – compounds into extraordinary outcomes because decisions are made together, calmly, and with shared understanding. The routine doesn’t require spreadsheets or complicated tools. It’s just a regular check-in: what are we working toward, how are we doing, and what needs to change? Families that do this rarely see wealth disappear in one generation. Those that don’t often wonder where it all went – lost to unspoken assumptions or late discoveries.

Start small: one conversation a month about progress and goals. Over time, it becomes the habit that turns normal earnings into lasting legacy.

Lightman Global

Thoughts on wealth topics that matter

How to Invest for Your Children’s Education

Let’s be real. As parents and as financial consultants, we all know that educating our kids is one of the most rewarding and most expensive journeys we’ll fund. With tuition, living costs, and inflation rising every year, a little planning today saves a lot of stress tomorrow. So let’s break this down in simple, practical steps you can actually implement.

Time is your biggest ally here. If you begin saving when your child is young, or even before they’re born, you give your money the longest runway to grow through compounding.

Waiting five or ten years later can dramatically increase the monthly amount you’ll have to save to hit the same goal. This isn’t just financial nerd talk: even AED 1,000-1,500 per month now can translate into a significantly larger corpus by the time your child reaches university age.

You cannot invest for something you haven’t quantified. Before you choose any product, calculate:

- The target amount you need (tuition, books, accommodation, travel, extras).

- The timeline (when your child will enter school, university).

- The monthly amount required to get there.

This is where discipline and clarity come in. Treat your child’s education corpus as a standalone financial goal. Having a separate SIP, dedicated investment account, or segregated fund helps prevent accidental use for home renovation, holidays, or other expenses. Tip from practitioners: keep it clearly labelled (e.g., “First Child’s Education Fund – 2041 Goal”) so you and your partner always remember its purpose. Thoughtful planning, early action, disciplined investing and regular reviews can turn what feels like a huge financial goal into a clearly mapped journey. Education isn’t just another bill-it’s a launchpad for your child’s future.

Lightman Global

Thoughts on wealth topics that matter

“Save” and “Keep Money in the Bank” Worked in Their Time and Why Blindly Following Them Guarantees You’ll Stay Middle-Class Forever

For generations, we were told the keys to financial success were simple: save money and keep it in the bank. That advice made sense when interest rates were high and inflation was low. Your savings actually grew just by sitting safely in a bank account.

Today they quietly trap people in the middle class. With interest rates near historic lows and inflation eating into purchasing power, cash in the bank often loses value over time. If you follow the old rules without adapting, you’re likely locking your money into a slow drift. Not growth. That means you may never break past the middle-class wealth ceiling you work so hard to escape.

Update the rules for today’s world.

Smart financial planning isn’t about sticking to old slogans. It’s about understanding the real drivers of long-term wealth. Asset allocation, disciplined investing, and strategies that align with today’s economic environment. Simply saving is essential, but it’s only the starting point, not the destination. The intention was good discipline and caution. The execution needs updating: live below your means, but invest the difference aggressively in growth assets.

At Lightman Global, we help clients move beyond outdated advice and build portfolios designed to grow with you – not hold you back. Let’s talk about how to make your money work harder.

Lightman Global

Thoughts on wealth topics that matter

The Real Reason Most Bonus Money Disappears Within Months (Part 1 of 2)

We’ve all been there: bonus hits the bank, we feel rich, and by the next quarter it’s like it never existed. But the truth isn’t just “we spend too much”. It’s deeper than that. First, we subconsciously treat bonuses differently from our regular salary. Our brains label it as “extra” or “fun money,” so we justify splurges we’d never make with our day-to-day income. This mental accounting makes a bonus feel like a reward, not part of our long-term financial plan.

The reasons this happens almost every time:

- No plan in advance, so it defaults to spending on whatever feels good right now - the money hits the account and the brain says “spend”

- Lifestyle quietly expands to absorb the “extra” - the new baseline becomes permanent, turning temporary windfall into permanent higher costs

Bonuses could change lives – building wealth, paying debt, funding freedom. Instead they usually just fund a slightly better few months, leaving no lasting impact. Most people never see it coming because the bonus feels “free”. The reality is it’s the highest-earning money you’ll ever receive – taxed at higher rates, earned through hard work, and rare.

So here’s the takeaway you can actually use this bonus season: decide before you receive. Allocate a portion for future goals, automate transfers, and give yourself a small but intentional splurge bucket. Your future self will thank you, and the next bonus won’t disappear like it was never there.

Handled wrong, it vanishes. Handled right, it becomes the seed for real change.

To be continued…

Next: Year-End Bonuses Feel Like Found Money – So They Get Spent Like Found Money – How to Make Every Bonus Permanently Change Your Life Instead (Part 2 of 2)

Lightman Global

Thoughts on wealth topics that matter

Year-End Bonuses Feel Like Found Money So They Get Spent Like Found Money How to Make Every Bonus Permanently Change Your Life Instead (Part 2 of 2)

We’ve all unconsciously treated bonus money like fun cash… A reward we somehow “don’t have to think about.” That’s because our brains don’t process it the same way as our regular salary: bonuses feel like windfalls, not budgeted income, so we justify splurges we’d otherwise avoid.

But what if that same bonus could actually change your financial life? The secret isn’t denial – it’s structure with purpose.

Bonuses handled this way compound into freedom. Extra retirement income, paid-off debt, or investments that grow quietly over time. One bonus redirected can become tens or hundreds of thousands later through the power of compounding.

Treat it like seed money for your future self. The version of you who wants options, not obligations. Many people spend bonuses because they feel “extra”. The wealthy see them as acceleration. A chance to pull freedom forward.

The reasons this happens almost every time:

- Decide What the Bonus Is For Before You Get It: If you pre-commit where the bonus will go, you bypass the emotional impulse to spend. Whether it’s debt, savings, investment, or experiences, naming the purpose upfront makes you think like an investor, not a consumer.

- Use a Proportion Rule (Like 50-30-20 for Bonuses): Financial planners often recommend splitting extra income like this; 50% to future wealth, 30% to liabilities, 20% to guilt-free rewards.

- Let Compound Growth Work for You: Investing even a chunk of your bonus early whether through Mutual Funds, a SIP, or other diversified vehicles lets it potentially grow over years or decades. Those decisions (not a fancy dinner or gadget) are what turn a bonus into lasting impact.

- Treat the Bonus as an Extension of Your Financial Plan, Not an Exception : Once you reframe it from “extra play money” to a financial milestone, your decisions change. You think strategically, not impulsively. At the end of the day, the bonus feels like free money because it bypasses our usual budgeting brain. But if you intentionally anchor it to long-term goals, that same bonus can become the catalyst that finally pushes your financial plan forward.

The habit takes one setup and zero ongoing effort. Next bonus, try it. Watch how one decision changes the trajectory.

Lightman Global

Thoughts on wealth topics that matter

Retire Early Without Becoming Cheap: The Balance Nobody Talks About

Financial independence is often sold as extreme frugality, cutting every expense, living on rice and beans forever, and denying yourself everything until you “escape”. The truth is quieter and far more sustainable: you can retire early and still enjoy life today without feeling deprived. Three keys make the balance possible:

- Save aggressively early while earning well high savings rate in your peak years creates the runway

- Invest for growth, not just preservation a sensible mix of assets that compound while you live normally

- Define “enough” before you reach it a clear number that covers a comfortable lifestyle, not an endless chase

Freedom is enjoying the journey, not enduring it. Many people burn out trying to save 70–80% of income by cutting everything enjoyable. The balanced path saves 50–60% while keeping travel, dining, hobbies, and family experiences intact. The secret is distinguishing between consumption that adds joy and consumption that just fills time.

Retire early stories that last are the ones where people look back and say “I lived well the whole way”, not “I suffered until I was free”.

Lightman Global

Thoughts on wealth topics that matter

Why Women Often End Up Wealthier Than Men in the Long Run (Part 1 of 2)

Across multiple studies and brokerage data, there’s a consistent pattern: women investors tend to outperform men over long time horizons – not because of secret formulas, but because of behaviours that compound quietly over decades.

This isn’t about gender superiority, it’s about discipline, patience, and behaviour. These habits don’t make headlines, but they build wealth quietly and powerfully over decades.

Here’s what the evidence shows:

- Women Trade Less Often (and That Matters) : Women tend to place more buy orders and hold investments longer, while men trade more frequently. Excessive trading can reduce returns significantly through higher transaction costs and poor timing.

- Patience Beats Performance Chasing: Data suggests women are more likely to stay invested through market ups and downs rather than reacting to short-term noise. This is a behaviour linked to better long-term outcomes.

- Informed, Comfortable Decisions Win: Women are also more inclined to research thoroughly and ask questions before committing capital, leading to decisions aligned with long-term goals and risk tolerance rather than headline-driven choices.

- Lower Risk, Better Risk-Adjusted Returns: Research shows women often choose moderated portfolio risk and are less likely to chase speculative, high-volatility trends. This can protect gains in turbulent markets. Men, on the other hand, often chase performance, take larger risks, and trade more. These behaviours are linked to overconfidence that can undermine returns over time.

This isn’t about gender superiority, it’s about discipline, patience, and behaviour. These habits don’t make headlines, but they build wealth quietly and powerfully over decades.

To be continued…

Next: The surprising habits that give women a quiet but massive advantage in building and protecting money over the long term. (Part 2 of 2)

Lightman Global

Thoughts on wealth topics that matter

he Surprising Habits That Give Women a Quiet but Massive Advantage in Building and Protecting Money Over Decades (Part 2 of 2)

- Focus on Long-Term Goals Over Hot Trends: Women are statistically less likely to chase short-lived trends or react to the latest must-buy. Instead, they prioritise long-term goals and stay anchored to their plans. A strategy that generally produces more reliable returns.

- Research and Advice Without Ego: Rather than relying on gut feelings or ego, women are more likely to seek advice, ask questions, and build confidence through understanding. This leads to fewer blind spots and better-informed decisions.

- Consistency Over Brilliance: Some investors wait for “the perfect opportunity” or constantly tweak allocations chasing perfection. Women, on average, stick with a defined strategy. Consistency, not brilliance, wins when compounded year after year.

When we dig deeper into why women outperform over the long run, a few additional behavioural strengths become clear – and they’re practical lessons any investor can adopt.

Anyone – man or woman – can benefit from these habits. You don’t need secret knowledge, just discipline, curiosity, and a willingness to anchor decisions in long-term planning rather than short-term excitement.

Because in investing, the quiet moves often make the loudest impact.

Lightman Global

Thoughts on wealth topics that matter

The Simple Weekend Review That Keeps Your Money on Track All Year

Ten minutes every Sunday can prevent most financial mistakes and keep your wealth building steadily. The review is simple but powerful – a quiet check-in that catches small issues before they grow into big problems. Three things to look at each week:

- Spending vs plan - where did money go last week, and was it aligned with goals? Spot leaks early.

- Progress toward goals - how much closer are you to savings targets, debt reduction, or investment contributions? Celebrate wins and adjust.

- Upcoming bills or opportunities - what’s due next week, and is there a chance to add extra to investments or pay down debt?

Small weekly adjustments beat big annual overhauls that feel overwhelming and rarely happen. Consistency turns these small checks into big outcomes over time – better habits, fewer surprises, steady growth. Most people only look at money when something feels wrong e.g. bills shock, low balance, missed goal. The weekend review flips that. You stay ahead instead of reacting, feeling in control every week.

Set a reminder, grab coffee, open your app or spreadsheet. Ten minutes invested now saves hours of stress later.

Lightman Global

Thoughts on wealth topics that matter

The Day You Stop Caring About Market Crashes (And How to Get There)

Seasoned investors barely notice market drops – they continue with their lives while others panic, checking prices hourly or selling in fear. The path to that calm is earned over time, not gifted. Three steps to reach genuine indifference:

- Proper asset allocation matching your real tolerance. A mix that lets you sleep during storms, not one that looks good on paper but feels terrible in reality

- Long time horizon. Knowing you have decades for recovery turns drops into temporary noise rather than existential threats

- Experience of past cycles. Living through one full bear and bull market teaches that crashes always end and recoveries follow for those who stay invested

Fear fades with preparation and time. Most new investors feel every percentage point – a 10% drop feels like disaster, a 20% correction like the end. Seasoned ones know markets have crashed many times – 1987, 2000, 2008, 2020 – and always recovered for those who stayed the course.

The day you stop caring is the day your plan is strong enough that short-term noise no longer matters – goals are on track, allocation is right, time is on your side. Until then, volatility feels personal. After a few cycles, it feels normal.

Build the plan when calm. Stick to it when stormy. Calm comes as a reward.

Lightman Global

Thoughts on wealth topics that matter

The Day You Stop Caring About Market Crashes (And How to Get There)

The path from fear to calm is step-by-step.

- First: build a plan you trust - allocation, goals, rules written when calm, tested against past scenarios, and simple enough to follow without second-guessing.

- Second: live through one full cycle. The fall, the bottom, the recovery. And see it works, proving to yourself that markets recover and plans hold when executed.

- Third: focus on goals, not daily prices. Your money is for life events, not ticker watching; check progress quarterly, not daily, to keep perspective.

Most people never reach it because they change plans during storms – selling low, buying high, reacting to noise instead of sticking to rules. Seasoned ones stay the course and barely notice the noise. Market drops become background, not emergencies. They know volatility is the price of long-term growth, and time heals all temporary declines. The shift happens gradually: the first cycle is scary, the second is uncomfortable, and the third is routine. By the fourth, you check prices occasionally and move on.

The secret is preparation before the storm and discipline during it. Build the plan now. Trust it later. Calm follows.

Calm is earned, not gifted.

Lightman Global

Thoughts on wealth topics that matter